Investing

Psychology

Being smart about your investing psychology that can put you way ahead

Your investing psychology describes the medium through which you have to work. There's still much to learn about how it all works together , but it is clear that

- Your brain is not a computer.

- Your eyes are not video cameras.

- Your ears are not microphones.

Constant filtering and attribution of importance and meaning goes on without your conscious awareness that determines even what data you use in making investing decisions, much less what you decide to to do with it.

Warnings that emotions send often lead to making bad investing decisions are largely correct.

That does not mean (as some say), however, that emotions have no place in investing and trading. In fact there is evidence that people with no emotional component to decision making actually do worse that those who've learned to manage it well.

It's not uncommon to hear people say "All I need to know is what to buy, when to buy it, and when to sell it. Leave out all the psychobabble and get right down to what to DO."

Actually, quite a bit is known about how people make decisions involving money that does tell you what to DO.

What you need to DO is get smart about how your mind and body react to the kinds of potentially dangerous, uncertain situations that you must operate in to invest and trade profitably.

Studies of investing psychology make it pretty clear that when money is involved:

- emotions are a given, fear and greed being most common.

- emotions can adversely affect your thinking, your decisions, your actions, whether positive or negative.

- limitations in perception and mental processing are significant, especially in the face of the amount of information available.

- your brain reacts to what it perceives as danger before you're even aware of it consciously.

- there are common, predictable neuro-cognitive biases, thinking errors, that lead to bad decisions simply because of how your brain works

Neuro-cognitive biases get a lot of attention for good reason.

The attention investing psychology has spent on these biases, (tendencies to see things in distorted, dangerous ways,) makes a lot of sense. Our nervous systems can come to erroneous conclusions that seem so right.

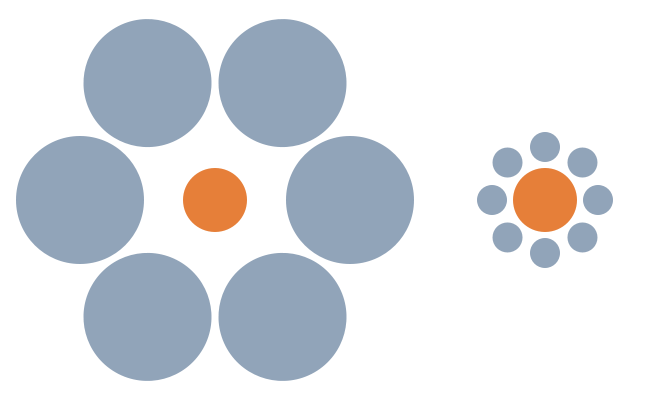

For example, take a look at the image below. It's called the Ebbinghaus illusion. Most people see the orange circle on the right as being bigger than the one on the left. It's not.

Even when I put a ruler up against the computer screen and the edges of the circle come out to exactly the same points, I find it almost impossible to believe.

The challenge, the route to success, use what is known about investing psychology to develop self-knowledge and skills that allow you

- to predict likely cognitive biases that affect your decisions

- to recognize when indeed you are experiencing one of these predictable biases

- to avoid making decisions solely on emotions

- to realize what limited information you are working with

Perceptual and mental illusions are largely predictable

Fortunately, many of the inherent human limitations and distortions in making sense of financial and investing information are well known by investing psychology and good work-arounds exist.

Two simple, generic takeaways are

- when making decisions involving money it is a good idea to go down a checklist of the most common neural/mental/emotional errors and assess how much each one might be affecting what you are about to do.

- using the same checklist, make some educated guesses about what other participants in the situation are likely to be doing and make your plan accordingly..

Some of the most common effects described by investing psychology include big names that psychologists like for precise definition reasons. By clicking on the links below, you can read plain language descriptions of them.

- illusion of knowledge

- disposition

- sunk costs

- selective memory

- fear of missing out

When you are nervous or excited, you are even more prone than usual to make logical errors and to fall for all kinds of traps

You'll hear over and over that fear and greed are what drive the

markets. Like most such sayings, there is a lot of truth in that. It

doesn't tell the whole story though, and it doesn't tell you what to do about your own

natural experiences of fear and greed that you will probably feel at one

time or another.

Arguably, not dealing effectively with these two states is at the core of why so many people consistently buy at the tops and sell at the bottoms.

Have you ever stopped to wonder seriously about who is on the other side of those transactions? Who's buying at the bottoms and selling at the tops? How do they do it when most people are doing the opposite?

You are operating in the same arena with highly skilled and motivated professionals

Don't ever underestimate just how challenging it is to succeed in investing and trading. If you start to get the idea that because you have been successful in other parts of your life and therefore sure can succeed at this to by applying the same skills and habits . . . watch out!

Very smart people who want to make a lot of money are naturally drawn to the various markets: stocks, bonds, options, futures, currencies. There's money there, lots of it. The stakes are high. And they are there to get it. That is their job and their purpose.

To

quote another old saying from the world of finance, . . . “We’re not an

eleemosynary institution!” For a definition and an interesting

discussion of that, CLICK HERE. It was a banker talking in this case, but you get the idea.

The professionals in investing and trading operate on the level of the professionals in athletics, the sciences, entrepreneurship.

One of the things that they have to do well to earn their money is not make the kinds of stupid mistakes that the amateurs do. In fact, it could be argued that they count on the amateurs making predictable mistakes. (They don't all always succeed, but in the long run that's what the best are doing.)

Think you can outsmart the pros at their own game? You might as well challenge Michael Jordan to a free throw shooting contest, but you can do very well when you stick to a discipline.

You don't have to beat the pros at their own game to do very well

The good news is that there are lots of effective ways to invest your retirement money that work quite well that aren't going head-to-head with the pros.

There are indeed many ways to succeed. Not matter which route you choose, after you've found a solid system with a good track record, that you understand, and that you feel good about, it's about you.

Through investing psychology studies we have learned that there are some common attributes of people who are successful investors.

They are likely --

- to take full responsibility for their actions and results

- to have chosen a sound system that fits their beliefs, personality, skills, and interests

- to include all the parts of a sound system including when and why to sell

- to include in their planning how they are going to manage their emotions when they become barriers to following their chosen system

- to be constantly watching for situations leading to predictable cognitive errors, and

- to measure their success at any given time by how well they are following their system, not by money

Doing more things that have been found to work well in a successful investing program is worth the effort

If there is any "secret" or "secrets" in all this, it is not which indicator or oscillator to use of which stock to pick, but rather how to get yourself to consistently do the things that investing psychology has shown to work and avoid the ones that don't.

Copyright @ 2008 - 2018 Better-Relationships-Over-50.com